(EAS Sarma)

I refer to the DIPAM communication No.FNo 06/01/2021-Dipam-V-part I dated 11-10-2021 in reply to my letter dated 26-2-2021 addressed to the Prime Minister in which I had expressed my objections to the proposal to privatise RINL.

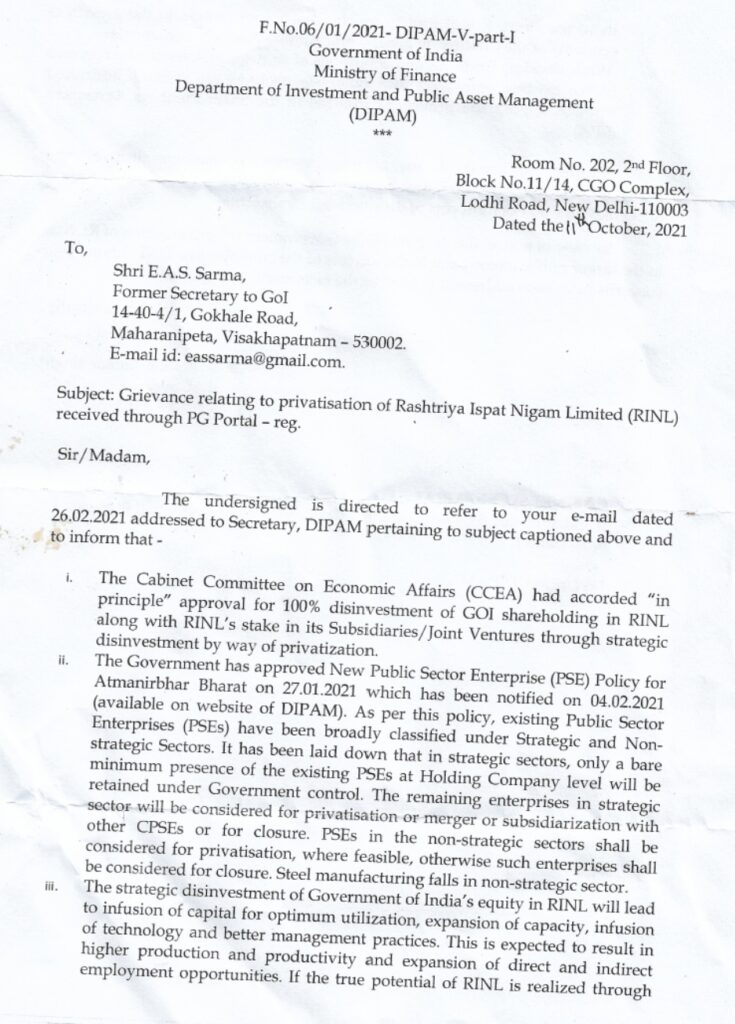

For your ready reference, I have enclosed here a scanned copy of the DIPAM letter.

Had the concerned Departments adequately briefed the CCEA on the implications of the proposal, the CCEA would not have taken a decision in haste on privatising RINL.

RINL came into existence when there was a widespread public agitation in Visakhapatnam for setting up a steel plant here. There were a series of debates on the subject in the Parliament. A statement was made in the Parliament by the Steel Ministry finally acceding to the public demand.

More than 20,000 acres of fertile agricultural land was acquired for the plant in pursuance of the then existing land acquisition law. When the farmers initially protested, the State govt clarified to them that the land was being acquired under Section 3(f)(iv) of the Land Acquisition Act as it existed then, which clearly implied that the land would be used exclusively for a “public purpose” defined in that clause as for a corporation “wholly owned or controlled by the government”. A 100% disinvestment of RINL would imply a change in the ownership of the company and an outright violation of the letter and the spirit of Section 3(f)(iv) of the Act and it would also amount to a serious breach of the public trust. Had this position been explained to the CCEA, the latter would have had second thoughts, as the CCEA could not have done something that is prima facie illegal. You may consult the Law Ministry on this if necessary.

The DIPAM letter also states that “surplus land..in respect of RINL will be hived off so that they do not form part of disinvestment transaction”, which implies that the non-surplus land would still remain a part of the disinvestment transaction. For the reason stated above, this will certainly violate Section 39f)(iv) of the land acquisition Act referred above.

I have come across a news report (enclosed) that the GOI will soon be seeking Cabinet approval for “monetising” the surplus lands of divestment-bound PSUs. On the face of it, this proposal would also be violative of Section 3(f)(iv) of the land acquisition Act as in the above case.

Moreover, it was the AP State govt that had faced the farmers whose lands were taken for setting up the steel plant decades ago. It was the State that negotiated on this with the farmers. As such, upholding the federal spirit that underlies the Constitution, the Centre ought to have consulted the State before rushing into this proposal to change the ownership structure of RINL. This matter ought to have been subject to a discussion in the legislative assembly of AP, in addition to a similar discussion in the Parliament, consistent with the spirit of a genuine Parliamentary democracy we have.

The process adopted in the disinvestment of RINL violates the disinvestment policy of the government. The Ministry of Steel had earlier entered into an MOU with a South Korean company, POSCO and the MOU contained a highly objectionable confidentiality clause in addition to a tacit approval for Singapore-based arbitration in the event of any dispute arising. India has had an unhappy experience so far with such overseas arbitration proceedings as in the case of Cairn and Vodafone. POSCO was expected to get 50% of the equity and the rest earmarked for a domestic company. In no way does this approach conform to the disinvestment norms of your Ministry, which incidentally are based on a report submitted years ago by Shri G V Ramakrishna.

Your contention that privatisation will contribute to the growth of RINL is misplaced as RINL’s contribution to the national economy is already considerable and its profits would have increased significantly had the Centre allotted a captive mine of good quality iron ore to RINL, a largesse that is usually given by the Centre to the private companies.

The National Steel Policy, approved by the Union Cabinet, envisages that steel PSUs like RINL would be groomed into becoming world leaders in the steel sector. The proposed disinvestment proposal in respect of RINL is diametrically opposite to this!

The track record of those private companies in India which acquired public assets had not been quite satisfactory. In Visakhapatnam, for example, we have HZL’s zinc smelter taken over by the Vedanta Group. The smelter has been mismanaged and the unit stands closed down. The company is now trying to hoodwink the Centre into allowing it to appropriate the land [ also covered by Section 3(f)(iv) of the LAAct] for diversion for commercial purposes, which is prima facie illegal.

You have referred to “strategic” and “nonstrategic” candidate industries for privatisation. In my view, the definition of a strategic industry as stated is a flawed one. Any industry that uses a non-renewable resource such as iron ore should remain in the public sector so that its output could be used for subserving the national interest and the raw material used in an optimal manner. Moreover, iron and steel products have a strategic importance for the economy and private control over them is detrimental to the public interest.

I may also point out that, with the relaxations allowed in the FDI limits, companies being hived off to private companies may slip into foreign hands soon. I would not be surprised if the Chinese acquire RINL once it becomes a private company. Is the Centre aware of this possibility?

The proposal to sell 100% equity in RINL will therefore be totally illegal and not in the public interest.

I suggest that both DIPAM and the Steel Ministry review the proposal in the light of these concerns and take back the proposal to the CCEA. I will have no objection to this letter being placed before the CCEA.

(Text of the letter written to T K Pandey,

Secretary, Ministry of Investment & Public asset Management, Govt of India)